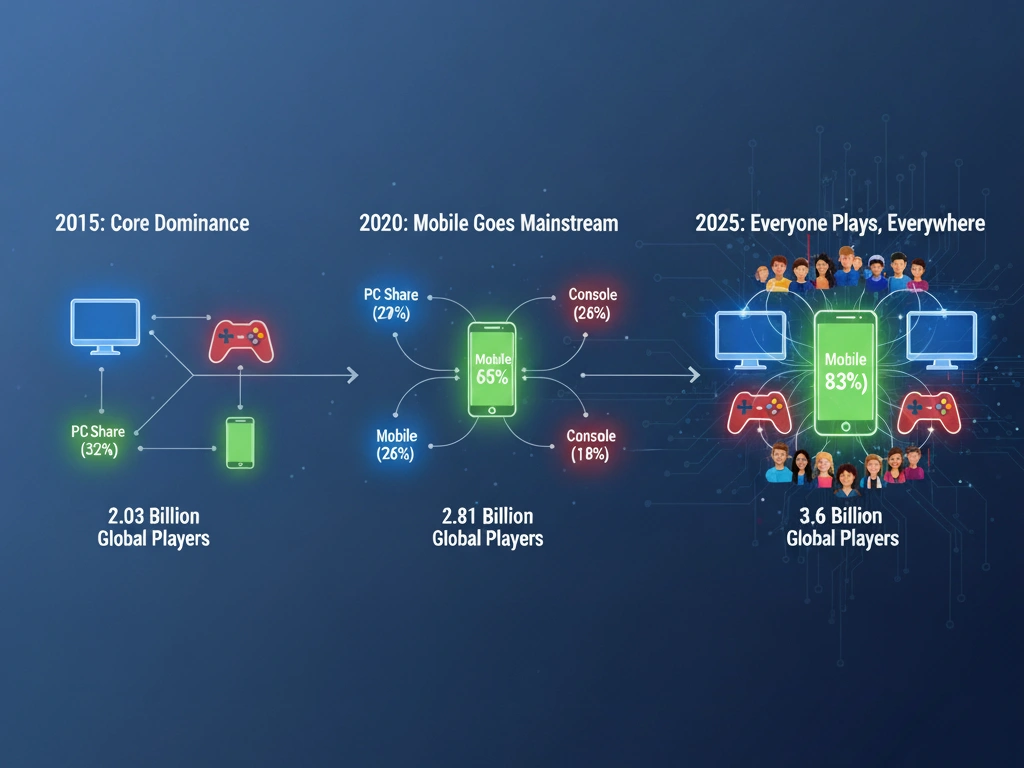

2015: PC and Console Enthusiasts

In 2015, the industry was still mostly “core.” You had PC enthusiasts, console loyalists, and the early stirrings of mobile. Monetization leaned on premium sales and DLC. Mobile was big in Asia, but Western devs often brushed it off as “casual.” (A mistake, in hindsight.)| Metric | 2015 | Notes |

|---|---|---|

| Global Players (Billions) | 2.03 | Mostly PC/console-focused markets |

| Mobile Share | 42% | Casual audience rising fast |

| PC Share | 32% | eSports and MMOs booming |

| Console Share | 26% | Strong cycle with PS4/Xbox One |

| Avg. Player Age (US) | 35 | Millennials and older Gen Z |

2020: Mobile Goes Mainstream

Fast-forward to 2020. Smartphones are everywhere, cross-platform engines are mature, and Unity and Unreal have made “build once, deploy everywhere” realistic. The pandemic hit, and suddenly everyone gamed. What was once casual became cultural infrastructure.| Metric | 2020 | Notes |

|---|---|---|

| Global Players (Billions) | 2.81 | Pandemic + mobile saturation |

| Mobile Share | 65% | Dominant platform |

| PC Share | 27% | Competitive + modding audience |

| Console Share | 23% | Switch era, PS4/PS5 crossover |

| Avg. Player Age (US) | 36 | Stable, older players staying engaged |

2025: Everyone Plays, Everywhere

By 2025, the numbers went way higher. More then three and a half billion players. Mobile completely dominant by reach. But here’s the kicker: the same player often uses multiple platforms. They might check in on mobile during lunch, then jump to PC for depth.| Metric | 2025 | Notes |

|---|---|---|

| Global Players (Billions) | 3.6 | Over half of all internet users |

| Mobile Share | 83% (3.0B) | Omnipresent |

| PC Share | 26% (0.94B) | Still valuable, high ARPPU |

| Console Share | 18% (0.65B) | Smaller, loyal core |

| Avg. Player Age (US) | 36 | Plateaued, wide generational spread |

Platform by Generation (2025)

| Platform | Gen Alpha/Z (5–29) | Millennials (30–43) | Gen X (44–59) | Boomers+ (60+) |

|---|---|---|---|---|

| Mobile | 77% | 78% | 79% | 81% |

| PC | 54% | 48% | 39% | 35% |

| Console | 58% | 55% | 39% | 43% |

Platform by Gender (US, 2025 Proxy)

| Platform | Male Players | Female Players |

|---|---|---|

| Mobile | 74% | 84% |

| PC | 53% | 40% |

| Console | 51% | 33% |

Designing for the Multi-Platform Future

Cross-platform isn’t just a feature anymore. It’s survival. Players expect to start a session on mobile, continue on PC, and maybe finish on console. Your backend, progression, and monetization need to travel with them. Here’s what works now (and what’s coming fast):- Mobile = acquisition. Use it to bring players in. Optimize your onboarding, store flow, and early retention.

- PC + console = monetization. These players spend more time and money when they care about progression.

- Cross-play = expectation. Seamless login, cloud saves, and social continuity are no longer “premium.” They’re table stakes.

- Older players = long-tail retention. They log in every day and churn less than teens. Worth building for.

- 2025 Gamers Report: Age, Gender, Location, Habits - Udonis Blog

- How Many Gamers Are There? (New 2025 Statistics) - Exploding Topics

- How Many Gamers Are There? (2025 Statistics) - Demand Sage

- Global games market to hit $189 billion in 2025 as growth shifts to console - Newzoo

- ABOUT THE COMPUTER AND VIDEO GAME INDUSTRY - ESA (2015)

- Annual ESA Study Reveals Video Games' Universal Appeal Across Generations

- 2025 Video Game Demographics: Stats & Trends to Know - TechJury

- ESA Essential Facts 2015 | Scribd Archive

- Gaming and Gamers - Pew Research Center

- Which Americans play video games and who identifies as a “gamer” - Pew Research Center

- Press release Niko 2015 Chinese Mobile Gaming Report

- 2020 Essential Facts About the Video Game Industry - ESA

- 2020 Global Games Market Report - Strive Sponsorship

- ESA report shows the average gamer is 41 – and nearly half are women (Reddit)